The Hidden Costs of Convenience : Are Buy Now, Pay Later Platforms Hurting the Economy?

- hallmic1

- May 22, 2025

- 3 min read

If you've shopped online recently you've likely seen Buy Now, Pay Later (BNPL) options for payment. I always hear things like cash is king, and when I worked in corporate America we were always concerned about cash flow. So this service was appealing to me. It reminded me of the days in the 90's and early 00's when my mom would use layaway at stores like Marshall's.

A few years ago when I first started seeing these services offered at checkout I decided to try it. I split the payment over 3-4 payments. In theory this was great, but over the next several months I quickly forgot about the charges only to see the expenses show up on my credit card unexpectedly. I decided that this wasn't the best option for me. I found it hard to manage my money when the installments were delayed.

Recently I've been thinking, are people really using this? I consider myself pretty financially responsible and I struggled with this. Was this an epidemic that no one is talking about? My skeptical brain told me that this could potentially be the next 2008, so I had to do more research to figure out what was going on.

In recent years, BNPL services like Afterpay, Klarna, and Affirm have exploded in popularity. Their pitch is simple: take your purchase home today, and pay in interest-free installments over the next few weeks or months. For shoppers, it feels like a win. Behind the convenience lies a growing list of risks, both for individuals and the economy at large.

The Allure—and the Trap

BNPL services appeal to our desire for instant gratification. No need to wait for payday, no lengthy credit card applications, no immediate hit to your bank account. But this ease can mask a troubling reality:

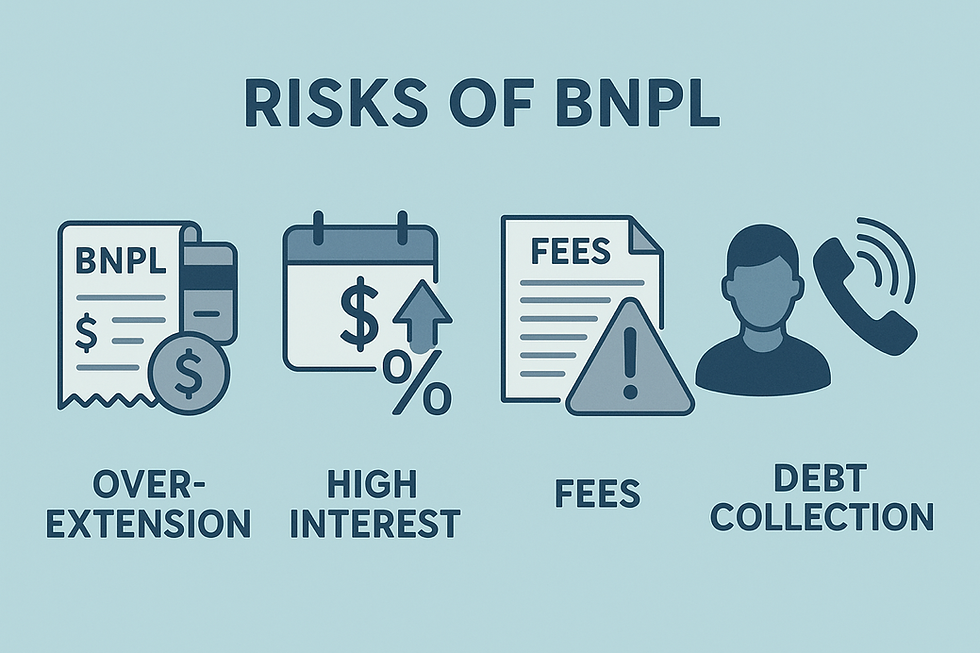

Overextension: BNPL makes it incredibly easy to overspend. When you only have to pay 25% upfront, the psychological cost of a purchase feels smaller. But as people stack installment payments across multiple purchases, they can find themselves juggling dozens of upcoming charges, often without a clear picture of how much they owe overall.

Fees and Penalties: While many platforms market themselves as “interest-free,” they still charge late fees, sometimes aggressively. Miss one or two payments, and that “free” purchase starts to resemble a payday loan.

No Credit Building, but Real Consequences: Unlike credit cards, most BNPL services don’t report on-time payments to credit bureaus, but they often do report missed payments. That means consumers can hurt their credit without any upside.

Lack of Regulation: BNPL operates in a regulatory gray area. There are fewer consumer protections than with traditional credit products, and oversight varies wildly depending on the provider.

Is BNPL Undermining Financial Stability?

While BNPL helps retailers boost sales and gives consumers flexibility, some economists warn it could be a ticking time bomb.

Encouraging Unsustainable Spending: BNPL fuels consumption beyond people’s means. This mirrors the over-leveraging we saw before the 2008 financial crisis, but now it’s happening at the consumer level and across millions of users.

Debt Without Transparency: Unlike credit card debt, which is centralized and tracked, BNPL debt is often fragmented across multiple apps and platforms, making it difficult to measure—and manage.

A False Sense of Affordability: Because the payments are small and spread out, consumers are lulled into thinking they’re budgeting wisely. But when bills from multiple services pile up, many find themselves in trouble.

Retail Addiction: BNPL is not just a financial product; it's a marketing tool designed to increase spending. In that sense, it promotes a culture of hyper-consumption that’s increasingly out of step with economic sustainability and personal financial health.

So, Are BNPL Platforms Ruining the Economy?

That may be an overstatement, for now. BNPL is not single-handedly crashing the financial system, but it is contributing to unhealthy financial habits at scale. When a significant portion of consumers are relying on delayed payments for basic shopping, it’s a warning sign that the broader economy is failing to provide adequate wages, savings, and financial security.

BNPL can be a useful tool when used responsibly. But it’s not free money, and it’s not a substitute for budgeting. If regulators don’t step in, and consumers don’t wise up, we may see a wave of defaults and financial stress echoing through households, retailers, and the economy at large.

Comments